Publish Date

Oct 11, 2022

The Right IT Investments to Speed Up Merger Integration and Unlock Value for Private Equity

Service / Industry: Private Equity

1. IT: The Value Dilemma

Over the past decade, the key objective of IT departments has been to reduce the costs of their operations. Managed as cost centers and under the direction of CFOs, often they were not integrated into the corporate strategy and business growth targets. Newly appointed CIOs’ complaints have largely been the same: their IT department is too slow, too inefficient, too expensive.

While almost every consumer in industrialized countries has become their own “IT expert” and appreciates the value of digitalization – after all, we all want our Amazon package delivered the very next day and preferably at no extra charge –, we have become increasingly impatient with our IT departments. Subsequently, IT departments are faced with the great challenge of proving the value of their budgets and investments. Communication is part of the problem: IT employees talk technical language and do not interact regularly with their respective business partners. Heads of IT very often do not sit at the C-level table and are neglected in discussions surrounding corporate strategy. However, digital leadership is not an optional part of being a CEO1– CEOs need to drive digital transformation, to actively engage with IT issues, and include CIOs/CTOs more fully.

2. More Than 70% of Digital Transformations Fail

Digital transformation is nothing new. Today, the majority of businesses have been in the process of transforming their IT for a few, if not more, years. Initiatives to move infrastructure to the cloud, implementing automation software, launching E2E-CRM systems, testing AI-based solutions and others are commonplace. While this sounds promising, surprisingly, only a fraction of companies are reaping the benefits of digitalization.

A recent study reveals that approximately 70% of companies fail in their digital transformation2. The most common pitfalls are:

- being stuck at the pilot phase with failure to scale initiatives and new technologies

- getting lost in projects and being unable to prioritize and finish projects

- lack of discipline to execute projects with a proper governance.

We observe these problems frequently in organizations that have grown through mergers and acquisitions. The IT activity remains fragmented, retaining its former structures without alignment and integration with the rest of the business. Employees sit comfortably within the structures of their silos and operate isolated IT stacks.

Overcoming these hurdles and integrating IT infrastructures take years, require significant CAPEX, and block internal IT resources which could be used for more valuable tasks. Essentially, IT is standing on its own way of realizing its full potential.

3. The Benefit of IT – Current Practice

When we begin working at new clients, we rarely stumble upon a mature and accessible internal IT organization. It is not uncommon to hear the CEO speak about IT as a “black box” or see the CFO frustrated by the lack of cost-benefit analysis when acceding to the CIO’s requests to finance large transformation projects. Budget constraints require prioritization – and IT is only one project of many, ranging from marketing campaigns to the establishment of new product lines. The question is always the same: what, exactly, is the benefit of IT?

The idea of linking investments into IT information systems to their financial benefits is most certainly not new, even though surprisingly few models have taken up the challenge until today. In 1995, Farbey, Land and Targett published what would become the first seminal paper on the topic, revealing their taxonomy of applications. Their proposed “benefits’ evaluation ladder”3 model made a significant contribution to the quantification of IT benefits and remains relevant 27 years later.

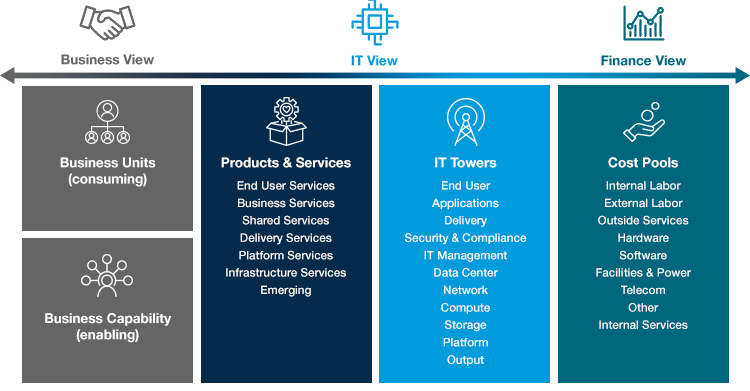

But today, we need to go one step further and ask: What does the business need from IT? Only rarely do businesses ask for Oracle or SAP specifically, for instance. Most business leaders are indifferent to technology solutions; they are actually looking for new future capabilities. This perspective was popularized by Tucker4 as he interpreted leading CIOs’ best practice in Technology Business Management (TBM):

Tucker’s model has been a key tool in facilitating the digital transformation journey. The model links a typology of business demands to the corresponding required IT technology and services, as well as respective IT costs. Business capability demand is voiced across a business’s different departments (e.g. marketing, finance, HR, engineering, supply chain, logistics) as these departments draft high-level and pragmatic requests for future capabilities.

Most often, this is done through narratives and simple use cases. Translation is key. This is where the IT department comes in. What does the simple use case mean in terms of technology solutions? Which software solutions are available that could provide the capabilities requested? Which of these align with the company’s IT architecture? Tucker’s TBM model seeks to connect these dots.

We at Alvarez & Marsal have developed these models further to provide businesses with specific value amounts – and a strong link between technology spent and their P&L statement. We expanded on the business capability perspective by taking advantage of EBITDA as a core finance metric. By calculating the cost-benefit case from an EBITDA perspective, we can provide CFO-level guidance as to whether an IT investment makes sense or not.

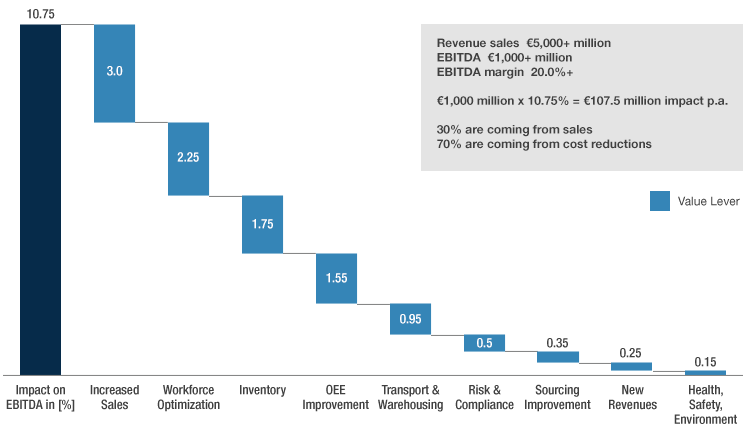

4. The Alvarez & Marsal Business Technology Approach: EBITDA impact of IT

Depending on the business’s needs, we calculate the top value levers within each digital initiative. For example, at a recent client engagement, we calculated value cases for the top two value levers within each proposed initiative. In our best-case scenario, all digital efforts were allocated to key clusters. First, in the marketing cluster we were able to quantify an EBITDA impact of 1.65% for the ‘NextGen E-Commerce’ digital initiative and express this value in monetary terms (e.g. euros). This is because the CRM software targets ‘increase of sales’ and ‘workforce optimization’ as the levers with the highest EBITDA impact. This is, of course, due to improved client targeting and price segmentation resulting from more precise customer data and real-time information. We were able to calculate an EBITDA impact of 1.5% and 0.15% respectively of the two levers – and assign euro values to each.

Having identified the value of various IT projects, we implement a prioritized IT portfolio management. Each digital initiative that had its EBITDA impact calculated will be assigned a specific implementation feasibility value. This allows us to identify quick-wins, big bets, and no-gos. We give recommendations to delay or reduce the scope of lower value initiatives and reveal prerequisites (‘essentials’) to unlock further value.

The identification of value levers and the calculation of respective EBITDA impacts make IT investments more tangible and allows for a better comparison of investments. A proper value case supports the CFO in checking whether IT strategy is aligned with corporate strategy.

5. IT Value – More Important than ever in M&A and Carve Outs

IT has taken on a prominent role in M&A and carve-out scenarios and has, deservedly, held a high rank on the agenda of PE companies. Potential buyers are certainly interested in the maturity of a target business’s IT. A high-maturity rate means boosted scalability as well as faster and less expensive integration of future acquisitions.

In IT due diligence, potential red flags and risks are often hidden behind a high amount of technical debt – which is a lack of IT investment over a longer period of time – and a poorly managed IT project portfolio.

Being able to calculate required future investments and their value in EBITDA has proven invaluable in such M&A scenarios. With A&M’s Business Technology EBITDA approach, the right IT investments are prioritized to unlock value. When this is done in a structured way, PEs can obtain an ideal technical set-up for future acquisitions or reap the benefits of a smooth and swift exit further down the road.

6. Conclusion and Key Takeaways

The quantification of the value of IT investments is of prime importance for today’s top-level management decisions. Only by fully integrating the value and cost of IT solutions can CEOs, CFOs, and CIOs make fully informed decisions on corporate strategy and reach their growth targets. Instead of investing millions and millions into IT projects with unclear timelines and financial benefits, PE firms and portfolio companies’ management teams should be calculating the value case of digital initiatives using an EBITDA approach.

1Bersin, J. (2016a, December 1). Digital leadership is not an optional part of being a CEO. Harvard Business Review. Retrieved from https://hbr.org/2016/12/digital-leadership-is-not-an-optional-part-of-being-a-ceo

2Saldanha S. (2019). Why Digital Transformations Fail – The Surprising Disciplines of how to Take Off and Stay Ahead. Oakland, Berrett-Koehler Publishers, Inc.

3Farbey, F., Land F., Targett F. (1995). A taxonomy of information systems applications: the benefits’ evaluation ladder. European Journal of Information Systems, 4:1, 41-50.

4Tucker, T. (2016). Technology Business Management – The Four Value Conversations CIOs Must Have with their Businesses. Bellevue, TBM Council.