Publish Date

Feb 15, 2024

SHOW ME THE MONEY, BUT THE RIGHT MONEY PLEASE!

Service / Industry: United States

Creating Value and Transforming Commercial Strategy

Given the complexity of the current economy, shaped by the challenges of rising interest rates and inflation, volatile markets, shifting business models, and financially strained vendors and customers, it is essential for organizations to take proactive steps to drive profitable sales and commercial performance. Interest rates and inflation have become dominant forces steering economic dynamics.

Companies must gain a clear understanding of where they are making money and be strategic around how and where they go to market. This forms the basis for a holistic approach to apply the following levers to create value and transform the commercial function to deploy this strategy cost effectively and set it up for scalable growth.

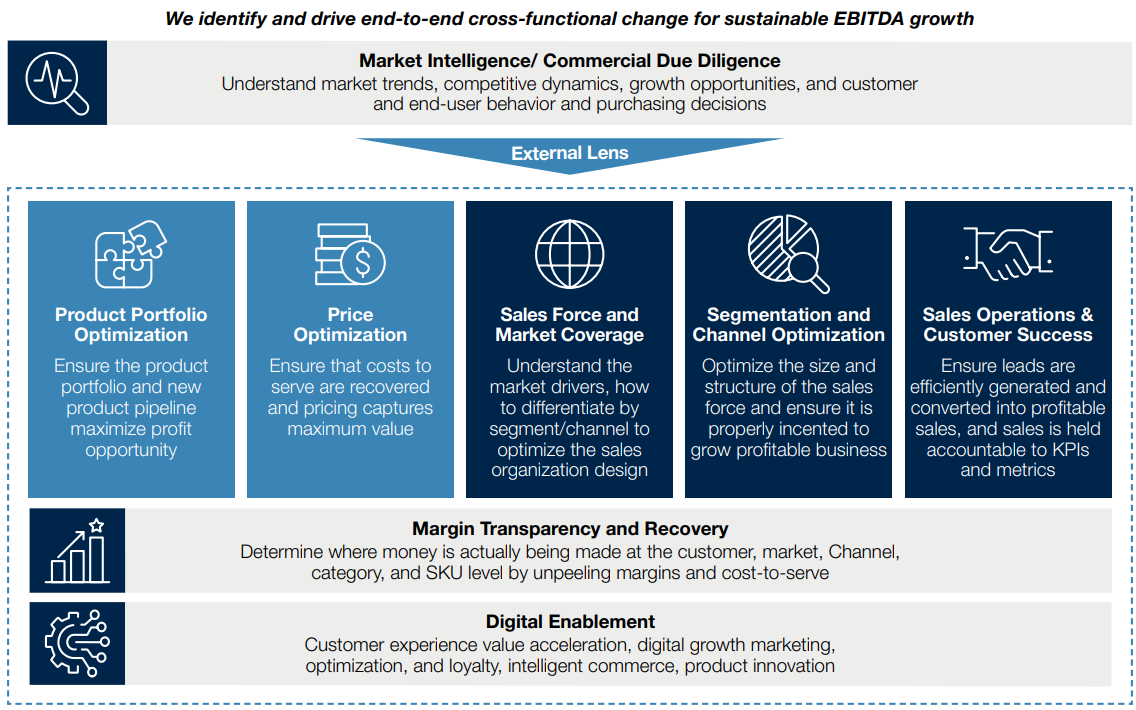

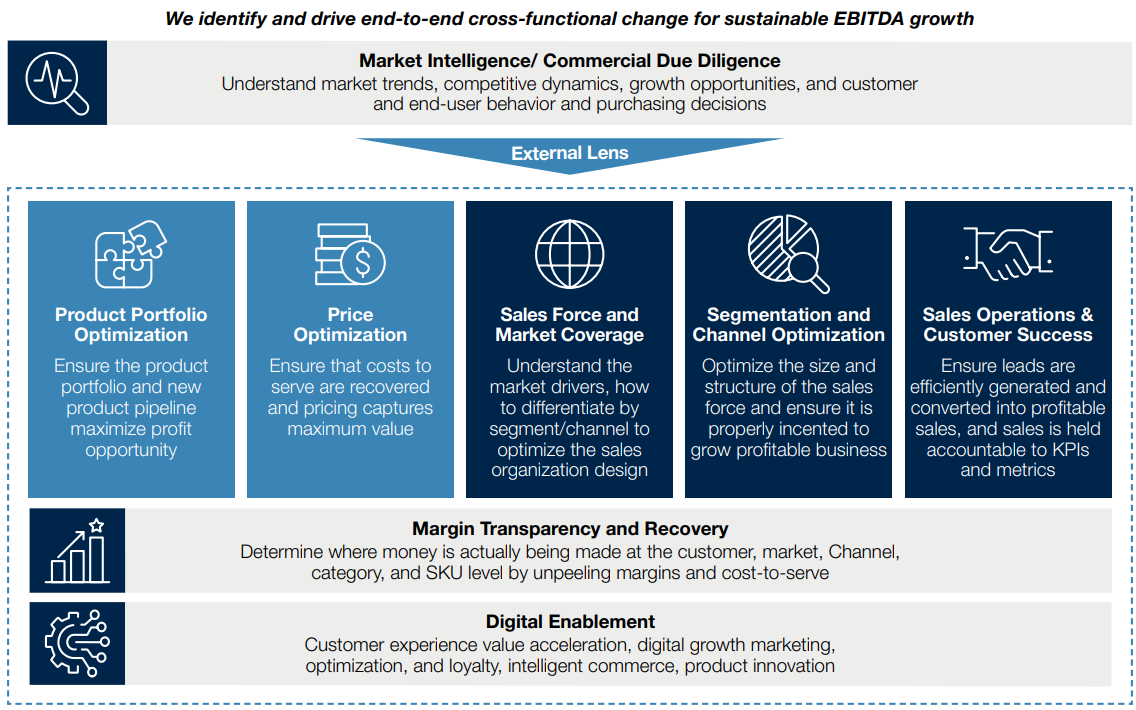

The following graphic outlines the foundation and 5 key pillars of A&M’s Systematic Approach to Commercial Excellence.

A&M Commercial Excellence Approach

A&M’s strength in execution drives a differentiated commercial excellence approach, divided into six key areas:

In Part I of our series, “Where is the Money?”, we discuss how understanding cost-to-serve and creating transparency on margins and the market are the foundation of an effective commercial strategy. This informs product and pricing strategy, sales organization structure and process to create an effective commercial strategy that drives profitable sales, customer success and cash flow.

In Part II of our series, “What is my Sales Force Doing?”, we examine how the sales force is sized, structured, and deployed to uncover and capture profitable growth opportunities.

In Part III of our series, “What Are My Sales Managers Doing to Move the Needle?”, we look at the sales management function within the organization and the importance of aligning incentives, systems, tools, and sales leadership to drive accountability and profitable growth.

In Part IV of our series, “How Do I Give Selling Time Back to My Sellers?”, we explore how the sales operations organization and digital experience allow sellers to spend more time selling, ultimately enabling customer success and profitability.