Publish Date

May 05, 2020

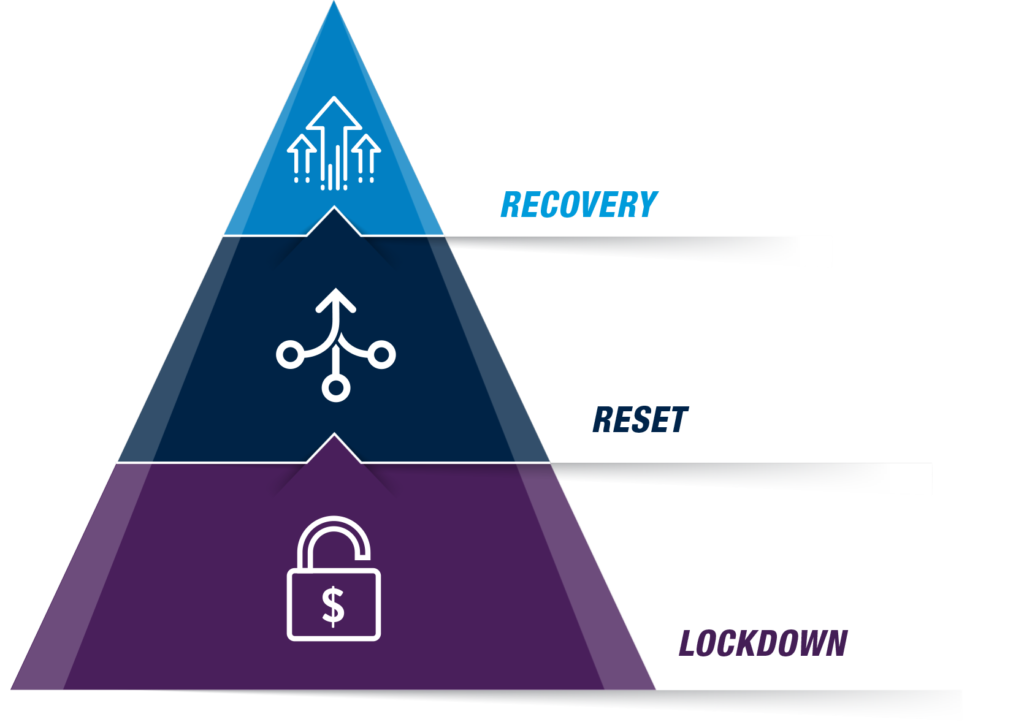

Pivot to Recovery

Service / Industry: A&M Rapid Results ProgramCFO Services & Interim ManagementInsurance & Risk Advisory ServicesOperations ManagementSupply Chain & Procurement Services

As we work with our private equity clients to address the ongoing issues related to cash constraints and liquidity management, we are now moving to the “reset” phase with portfolio company management to plan the re-entry into the market place. Leaders who have a vision of how their companies will survive and thrive after the lockdown are focusing on more operational issues, closely linked and managed with tight financial controls.

Read here for an overview of our approach to Pivot to Recovery.